A lot of people suggest that bitcoin and other cryptocurrencies will be resilient in an economic recession like the tried and tested U.S. Treasuries and gold. Bitcoin has not been tried and tested in a major U.S. recession, raising doubts about how well it will perform in the incoming recession.

Bitcoin Resilience in a Recession

The distribution of returns for U.S. Treasures and S & P 500 suggests that during periods of recession, bonds usually outperform equity. The distribution of a wide range of indices reveals that gold increases its returns during a recession. For this reason, many people see gold as a good hedge during times of uncertainty. Some people hold similar sentiments about gold. However, there are major differences between bitcoin and gold.

One of the biggest challenges in assessing bitcoin as a hedge in a recession is that it hasn’t been around when the last recession in the U.S. took place. Bitcoin has not operated through enough recessions to prove its value as a hedge in recession.

The volatility of bitcoin makes it less attractive as a hedge because of its associated risk. While gold has a volatility of 13.4% and commodities have volatility of 35 – 38%, the three largest cryptocurrencies (including bitcoin) have volatility that is over ten times that of gold. The volatility of the cryptocurrencies can increase as price drops.

Volatility Spikes of Cryptocurrencies

The volatility spikes of cryptocurrencies show that it is far from a safe harbour. During equity sell-offs in the past, there were several cryptocurrency sell-offs, which further heightened volatility of major digital assets like bitcoin.

The largest draw-down for bitcoin started at the end of 2013. Bitocoin lost 85% of its value which meant that it took over a year to crash and two years to recover to its previous value. It’s next biggest drawdown was in 2018, when a sell-off took place which the cryptocurrency still has not recovered from.

The low correlation of Bitcoin with equities and bonds could be seen in a positive light as this could mean that it serves as a better investment when the other markets are losing money. However, the benefits of diversification could be wiped out by its high volatility.

Security of Cryptocurrencies

Cryptocurrencies are easier to steal in many cases than stocks. They require a higher level of attention to detail as security must be prioritized if one holds cryptocurrency.

Despite their continued devaluation, governments hold a firm stance against the use or ownership of cryptocurrencies . More governments have tried to create digital currencies for their economies. This makes the cryptocurrency less attractive as a safer form of investment during a recession.

Most of the population will be deeply affected by a recession. Bitcoin was made as a solution for the average joe. Even with a small probability, the risk to reward ratio is too enormous to ignore.

Bitcoin derives much of its value from the hope of investors that one day it will serve a function as fiat money does. For now, Bitcoin is too volatile for the average joe to stake in for the purpose of increasing their purchasing power as a consumer in the economy. However, an investment of 5% or 10% limits the losses that could be accrued.

https://www.youtube.com/watch?v=uPvj_Ny3nl8&t=118s

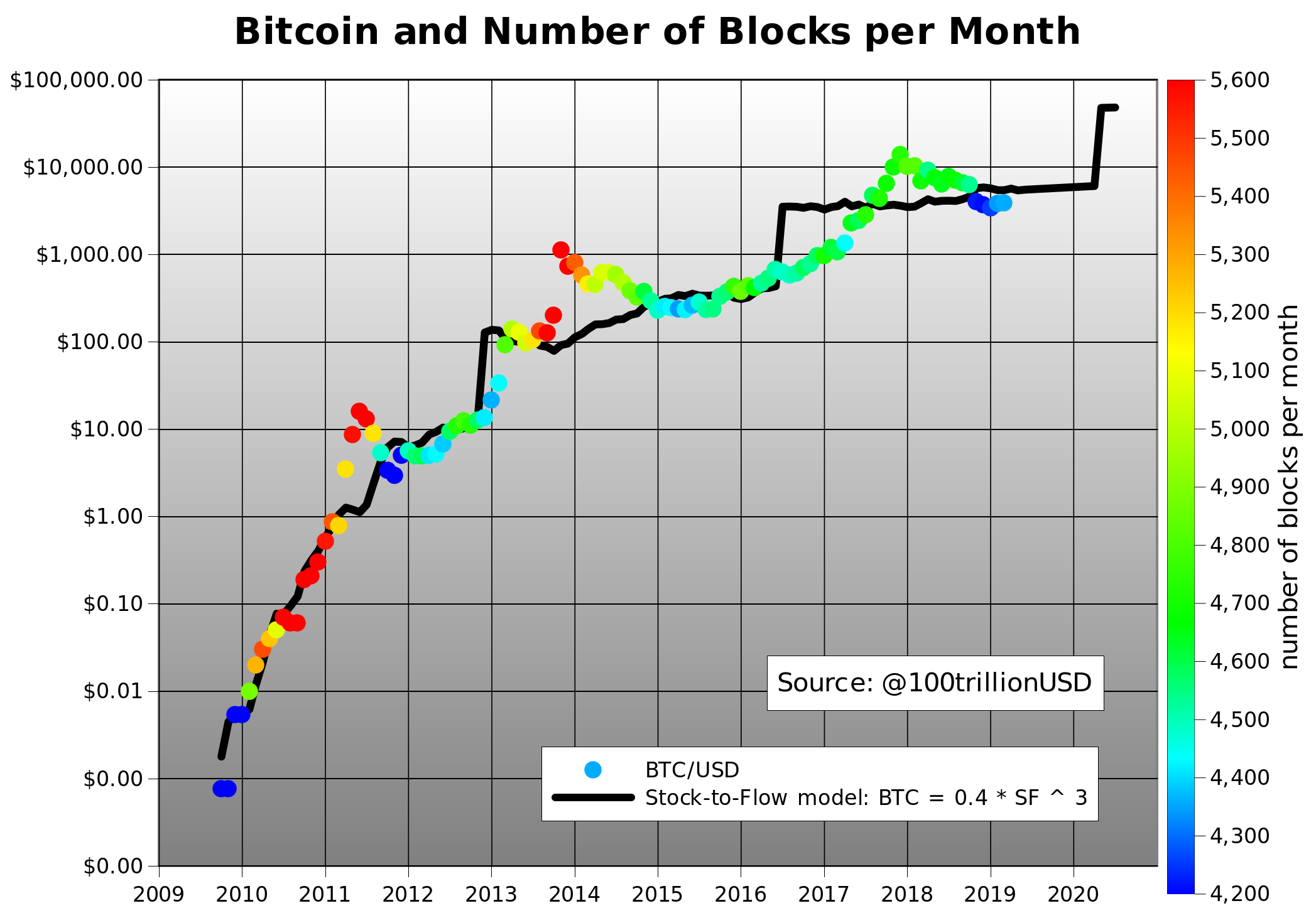

Predictable Busts and Booms

Bust and booms are relatively predictable. The length between boom and busts in economies do not go away. They may be extended but they cannot be avoided. In 2019, interest rates rose as the Fed tried to slow the economy down by raising borrowing costs. Unprepared for the events sof 2020, the economy will inevitably find itself with many great challenges in the coming months.

The largest group of people (baby boomers) in history have been preparing to go into retirement. With the largest debt pile in history combining with a global recession, their entire savings could be wiped out.

Bitcoin serve as the solution for many who move through the trenches of the recession. Households in economies that have experienced major economic downturn since its creation have benefited from using the cryptocurrency.

Owning bitcoin allows for one to opt out of the dwindling financial system. It presents an escape from the challenges presented by the mounting debt and weak system.

Choosing Gold Over Bitcoin

Most Bitcoiners want to dip their feet into less risky commodities like gold and silver precious metals. More and more bullion companies are offering the option to purchase bitcoin gold with virtually no costs, or even discounts.

Some investors are choosing to only make the move to bitcoin in a recession to purchase bullion. Those who choose to make the move use services such as ShapeShift or Changelly, or trade in common exchanges such as GDAX / Coinbase or Bittrex to turn alternate coins into Bitcoin, which can be used to facilitate direct transactions for metals. While there are not a lot of places to buy cryptocurrency using one’s IRA, there are still organizations that provide for this.

Gold and bitcoin share a mysterious connection. There is, on the one side, a major convergence between investors in both, particularly from libertarians who do not trust the U.S. dollar. Yet campaigns, on the other hand, have tried to place bitcoin as a more compact, divisible, and scarce investment than gold.

The Silver Lining

Bitcoin is a truth machine designed to eradicate fraud and improve validity and certainty in markets. Over ten years, it built a positive record which beat the low expectations of skeptics. The incoming recession will reveal many inconsistencies in equity markets and other markets which cannot be found in the bitcoin market. The security of the network has been maintained by machines, which reveal its truth. The majority of crumbling markets have not.

While some argue that bitcoin is not backed by anything of value, the fact remains that perception of value changes over time. Some would argue that gold has gained a significant proportion of value because of perception of its value by people.

In a digital age where more people are working from home, the perception of value and the borders between ecosystems is likely to change, making digital money more attractive. Coronavirus will change the world of work for many around the world as the digital economy grows.

Edel is an Editor with a decade of print and digital media experience – specializing in Science, Technology, Finance, Entertainment, and Advertising. He is also a stock and cryptocurrency investor. When Edel is not editing or analyzing charts, you can find him with his DIY lightbox taking timelapses of plants.